SINGAPORE, Jan 20 (Reuters) – Donald Trump’s newly minted cryptocurrency soared on Monday to top $9 billion in market value, drawing in billions in trading volume just hours ahead of the U.S. President-elect’s return to the White House.

The meme coin, also known as $TRUMP, surged 73% to $46.06 during Asian hours on Monday, giving it a market capitalisaton of about $9.2 billion, according to CoinMarketCap

, opens new tab. Its 24-hour trading volume reached $42.2 billion.

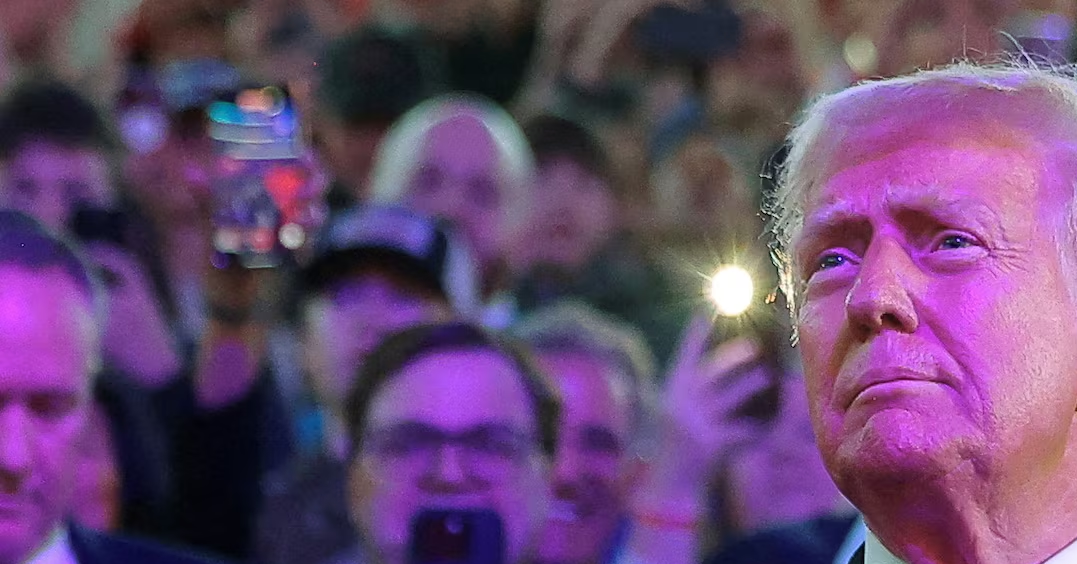

Trump had on Friday launched the digital token branded with an image from his attempted assassination in July, expanding his cryptocurrency interests that already include World Liberty Financial.

Even cryptocurrency community participants were surprised by the launch of Trump’s meme coin.

“While it’s tempting to dismiss this as just another Trump spectacle, the launch of the official Trump token opens up a Pandora’s box of ethical and regulatory questions,” said Justin D’Anethan, an independent crypto analyst based in Hong Kong.

While the coin represented a blending of the world of decentralised finance (DeFi) into the political arena, it also “blurs the lines between governance, profit, and influence,” D’Anethan said.

“Should public figures, especially those with such political clout, wield this kind of sway in speculative markets? That’s a question regulators are unlikely to ignore,” he said.

Peter Schiff, chief economist and global strategist at Euro Pacific Asset Management, pointed to the jump in $TRUMP’s value and called it the new digital gold, on messaging platform X.

Trump has promised to be a “crypto president”, and is expected to issue executive orders aimed at reducing crypto regulatory roadblocks and promoting widespread adoption of digital assets.

He is due to assume the presidency at noon ET (1700 GMT) on Monday.

The prospect of looser regulations around crypto policy has been met with fanfare by the industry and had turbocharged a rally in bitcoin following Trump’s election victory in November.

The world’s largest cryptocurrency last traded 2.6% lower at $101,826.51 on Monday, and is up more than 10% for the month thus far.

Sign up here.

Reporting by Rae Wee and Vidya Ranganathan; Editing by Muralikumar Anantharaman

Our Standards: The Thomson Reuters Trust Principles.