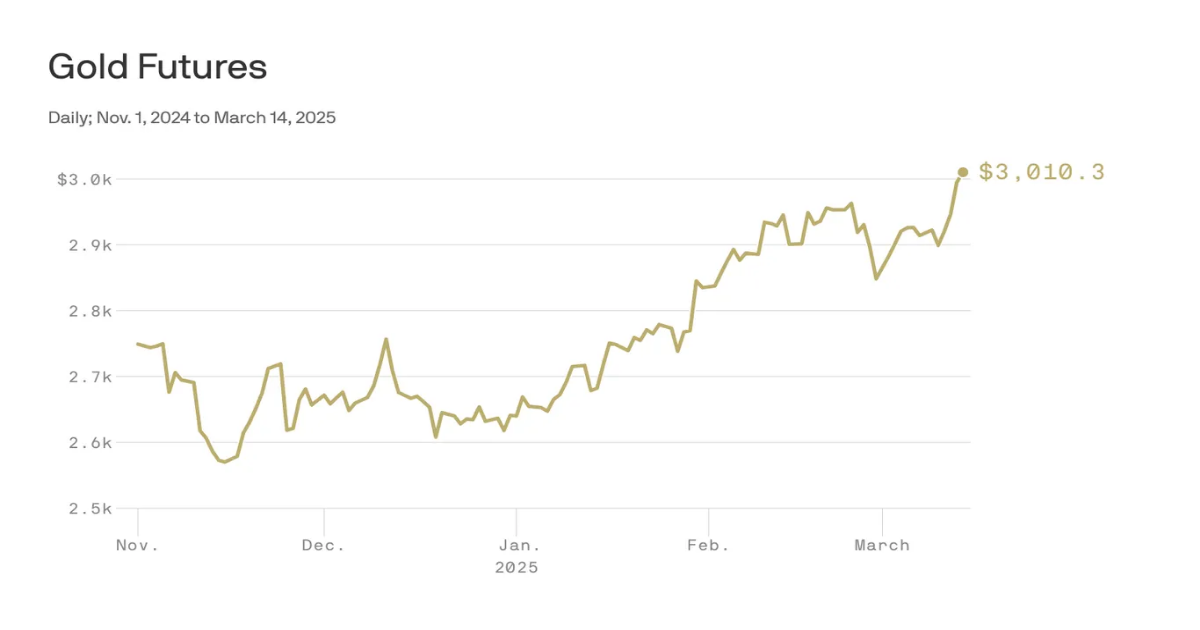

Data: Financial Modeling Prep; Chart: Axios Visuals

Gold hit a new all-time high Friday, breaking $3,000 for the first time ever, as investors search for tariff safe-havens.

Why it matters: There’s a psychological value to important assets breaking through big, round numbers — but it’s also further evidence of the market’s nerves and uncertainty about global trade.

By the numbers: The new gold all-time high came Friday morning, crossing $3,000 just after 4 a.m. ET.

- The yellow metal is up about 10% since President Trump won the election last November, outperforming most other asset classes.

Zoom out: In difficult times, investors search for “safe” assets that are likely to retain more of their value, regardless of geopolitical disruptions.

- So much gold was brought into the U.S. earlier this year, in a bid to front-run tariffs, that it skewed the trade deficit and messed up key calculations of economic growth.

The intrigue: The new record for gold comes just a few hours after the biggest U.S. stocks entered correction territory, 10% off their all-time highs set less than a month ago.

- “A key factor behind the recent market selloff is the uncertainty surrounding trade tariffs and their economic implications,” LPL Financial chief technical strategist Adam Turnquist wrote in a market commentary earlier this week.

- “The lack of clarity regarding tariff policies has made it difficult for markets to stage a meaningful recovery, as investors hesitate to make significant moves without a clearer outlook.”