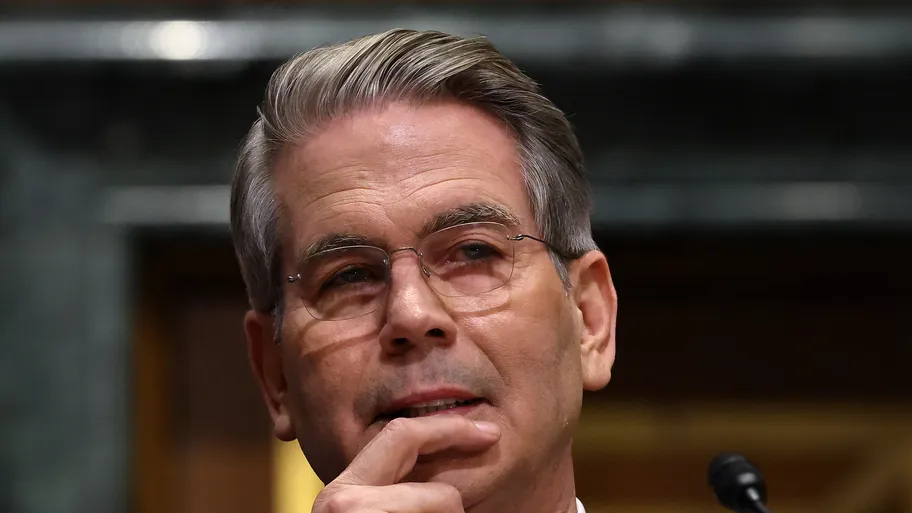

Anti-corruption advocates say that suspending BOI enforcement may have national security consequences. Photo by Chip Somodevilla/Getty Images

Anti-corruption advocates say that suspending BOI enforcement may have national security consequences. Photo by Chip Somodevilla/Getty Images

The Treasury Department announced on Sunday that it will suspend fines and penalties linked to “beneficial ownership information” (BOI) required of millions of businesses.

Why it matters: In addition to eliminating guardrails around “illicit finance,” anti-corruption advocates say the move may also have national security consequences for the U.S.

What they’re saying: The Treasury will cease enforcement of BOI penalties and fines, the department said in a statement, and it will issue “proposed rulemaking that will narrow the scope of the rule to foreign reporting companies only.”

- “Today’s action is part of President Trump’s bold agenda to unleash American prosperity by reining in burdensome regulations, in particular for small businesses that are the backbone of the American economy,” Treasury Secretary Scott Bessent said.

- “The Biden rule has been an absolute disaster for Small Businesses Nationwide,” Trump wrote on Truth Social yesterday.

The other side: Scott Greytak, director of advocacy for anticorruption organization Transparency International U.S., warned that the move could make the country more vulnerable to illicit activity.

- “This decision threatens to make the United States a magnet for foreign criminals, from drug cartels to fraudsters to terrorist organizations,” Greytak said in a statement.

What is BOI?

BOI is a feature of the 2021 bipartisan Corporate Transparency Act, requiring companies doing business in the U.S. to identify the individuals who own or control them in an effort to “curb illicit finance.”

- Shell companies, for example, can hide illegal activity more easily without having to report their owners.

Zoom in: “Corporate anonymity enables money laundering, drug trafficking, terrorism, and corruption,” former Treasury Secretary Janet L. Yellen said last year, when the Treasury Department’s Financial Crimes Enforcement began accepting DOI reports.

- “Having a centralized database of beneficial ownership information will eliminate critical vulnerabilities in our financial system and allow us to tackle the scourge of illicit finance enabled by opaque corporate structures.”

By the numbers: Reporting measures applied to about 32.6 million businesses, according to federal estimates.

- Following several court delays, Treasury had set a set a March 21 deadline for businesses to report the new information related to the rule. Non-compliance was to be penalized $592 per day in civil fines, with as much as $10,000 and up to two years in prison in criminal charges.

What’s next

Treasury said it intends to solicit public comment on potential changes to BOI reporting requirements later this year.

- While seeking to narrow reporting requirements to only foreign companies, Treasury said will aim to make sure BOI “is highly useful to important national security, intelligence, and law enforcement activities.”